Tradition on a quarantined Easter

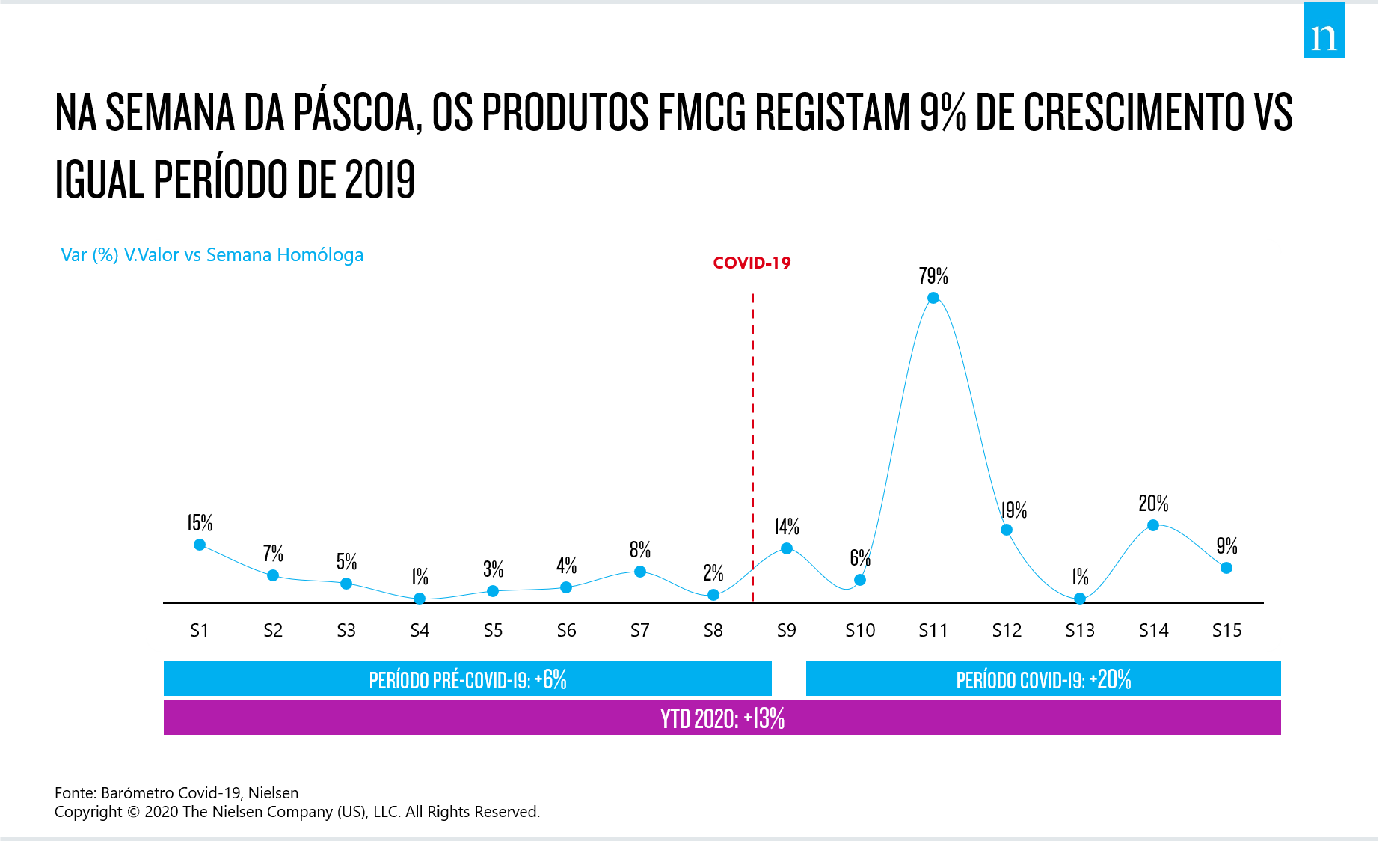

- Growth of 9% in Major Goods Consumption in week 15

- Online sales continue to grow

- Fresh produce, confectionery and beverages stand out on the Portuguese table

- Home and personal hygiene lose out due to storage effects

- Consumption rises in several European countries

The sixth edition of Nielsen's weekly Barometer on the impact of the pandemic coincides with the Easter celebration week. In week 15 (April 6 to 12, 2020), sales of FMCG products were around 181 million euros, an increase of 9% compared to the same period last year and a stabilization of consumption compared to the previous week.

This period, associated with one of the most significant religious celebrations and dates in the family calendar for the Portuguese, was marked by the impact of the restrictive measures integrated into the national State of Emergency, namely the control of traffic, which brought with them changes to the usual routines of this time of year.

Boosted by the lockdown at home, online sales continue to grow at a very high rate. This week, the number of online shopping occasions grew by 110% and by 128% in new households.

Easter table boosts consumption

The quarantine doesn't seem to have stopped the Portuguese from having the essential products and dishes on their tables at this time of year, leading to growth in the Food (+13%), Drinks (+8%) and Fresh (+1%) categories.

Confectionery and Sweets (+14%) entered this week's ranking of the fastest-growing categories in Food; Alcoholic Beverages and Beers/Ciders/Panaches both recorded an increase of 18%; and Vegetables and Butchery, especially Sheep/Goat meat (+83%), stand out among Fresh Products, suggesting that meals at home have become more popular and proving that consumers have maintained tradition at the table.

Tradition

"The trends analyzed show that, despite the unprecedented situation in which we find ourselves, the Portuguese have not overlooked one of the most important dates in the calendar, either because of its religious connotations or because of the usual reunion of families around a shared table.

This attempt to ensure possible normality and continuity of tradition in the context of the pandemic and lockdown has led to a notable increase in certain food segments, motivated by the demand for the usual products.

There is a clear tendency among consumers not to abandon the products they are used to, even during a huge challenge such as the current one, and so the role of a number of categories that are closely related to core values such as family and sharing seems to be assured," explains Marta Teotónio Pereira, Senior Client Consultant at Nielsen.

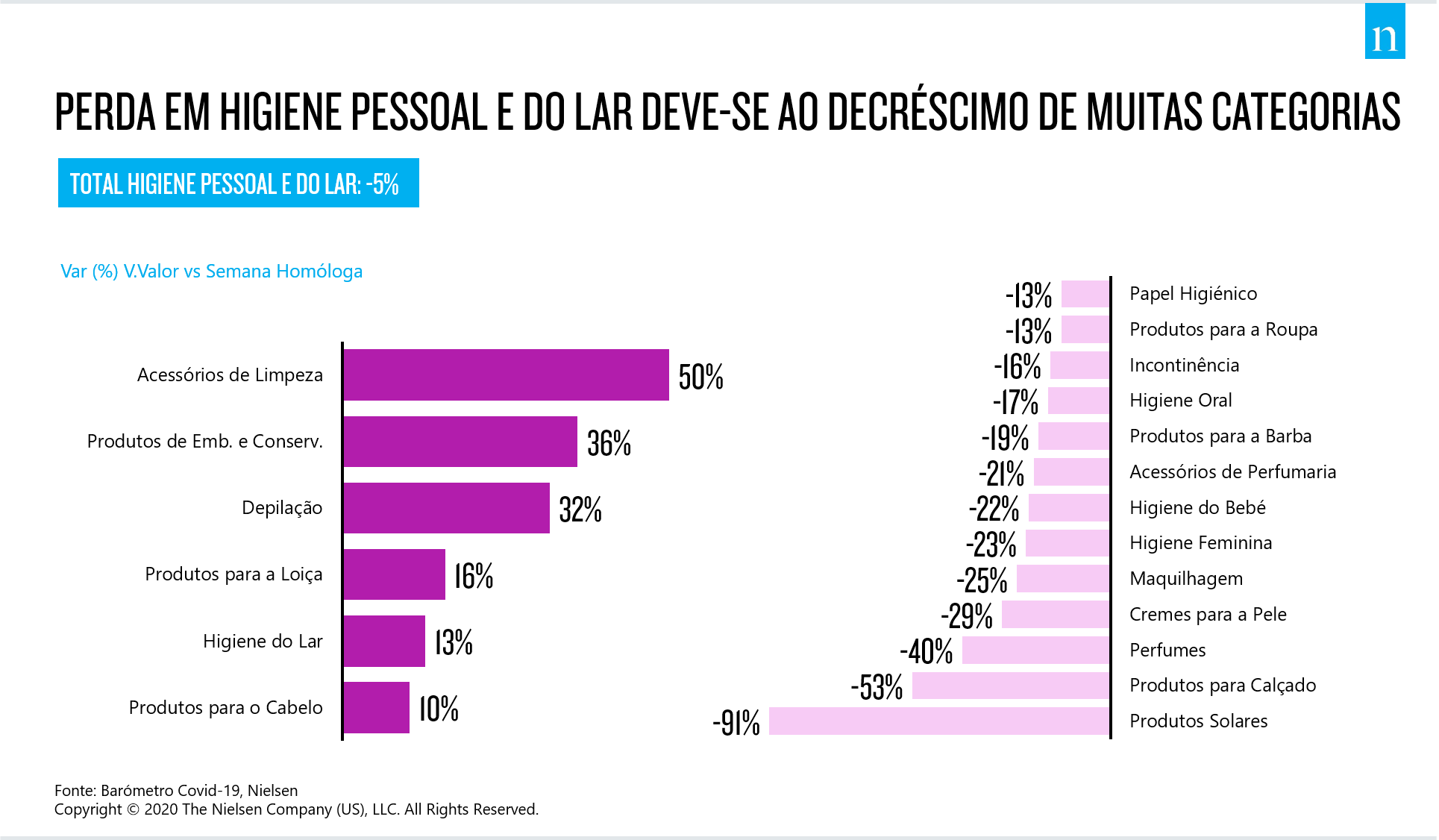

Storage leads to loss in Personal and Home Care

This week saw a drop of 5% in the Personal and Home Care category, driven by the decrease in many categories due to people being at home, but also provided by the storage already carried out in previous weeks.

This trend is reflected in the decrease in Toilet Paper (-13%) and Laundry Products (-13%), for example, which had seen increases in previous weeks.

Private label goes bust

If Private Brand had been gaining weight more clearly since week 11, when the Portuguese prepared their larder to "face" staying at home, week 15 shows a reversal of this trend, with its importance decreasing compared to the previous week (31.7% versus 33.2%).

The promotional trend, on the other hand, is positive due to the increase in importance of the leaflet, which, after a low in week 13, now seems to be gaining ground again.

Dynamics align in the European context

After a week in which the dynamics in the European context presented different realities of response to the pandemic, in week 15 there seems to be an alignment in this indicator.

Portugal, Spain, Italy, France and the United Kingdom all showed increases compared to the previous week, showing a general increase in consumption in a period traditionally marked by a celebratory atmosphere.

About Nielsen:

Nielsen Holdings plc (NYSE: NLSN) is a global data measurement and analysis company that provides the most complete and reliable insight into consumers and markets around the world. Nielsen is divided into two business units. Nielsen Global Media, the truth indicator for media markets, provides the media and advertising industries with unbiased and reliable metrics that create a shared understanding of the industry necessary for markets to function. Nielsen Global Connect provides consumer goods brands and retailers with accurate, actionable information and insights and a complete view of a complex and changing marketplace that companies need to innovate and grow.

Our approach combines original Nielsen data and other sources of information to help global clients understand what is happening now, what will happen in the future and how to act on this knowledge.

An S&P 500 company, Nielsen is present in more than 100 countries, covering more than 90% of the world's population. For more information, visit https://www.nielsen.com/pt/pt/.

Contact details of Press Office

Say U Consulting