Lisbon, March 25th, 2019 - A Nielsen held the presentation "Winning into the Promo Jungle", an initiative with the aim of pointing out some measures through which companies can get a more complete picture of the FMCG promotional market in Portugal. In a context in which promotional sales amount to 3.5 billion euros - the global figure for 2018 - Nielsen's data served as a starting point for explaining the detailed evolution of promotions in the Portuguese market, assessing their effectiveness and showcasing successful promotional mechanics from other countries.

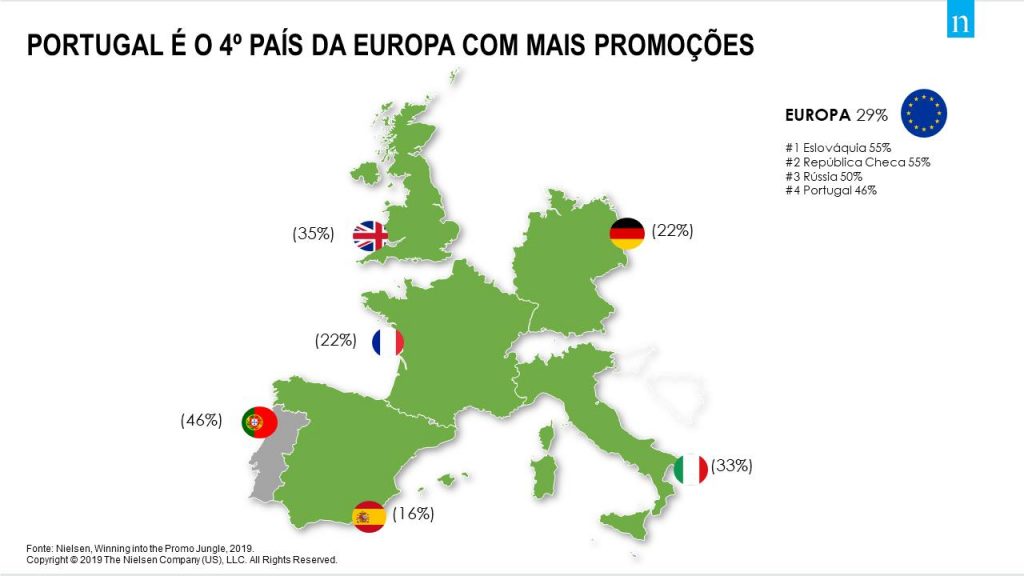

The panorama in the domestic market reveals the central importance of the promotional phenomenon, which becomes notorious when we compare the Portuguese reality with the European one: Portugal is the 4th European country in which promotion acquires greater weight and almost half of the sales (46%) in the domestic market in 2018 were made through promotion.

Almost half of Portuguese consumers (versus only a third of Europeans) assume that, even if they don't change stores because of promotions, they actively look for them when shopping. Furthermore, a third of shoppers choose their brands according to current promotions.

We know that 20% of households in Portugal concentrate 50% of promotional sales: these are the promo seekers. This cluster is identified by families with 4 or more members, of medium-high socio-economic level, with a shopping frequency of 4 times a week and an expenditure of €24, opting especially for Manufacturer's Brands, which are usually on sale.

To João Otávio, Senior Client Development from Nielsen, "there is no doubt that promotions play a decisive role in consumption in Portugal. However, more than half of promotional sales correspond to non-incremental sales, i.e. sales that would have been made anyway (with or without promotion). This investment of 3.5 billion euros in promotion must be strategically directed towards a world of opportunities. Nielsen's role, through the implementation of more sophisticated studies, is to understand how brands can increase their promotional efficiency and which types of promotion and product they should actually invest in to generate incremental sales for both manufacturers and retailers."

Between 2017 and 2018, more than half of the sales in the FMCG categories (54%) decreased their promotional efficiency. In fact, Nielsen predicts that, if the current strategy is maintained, efficiency will not increase in Portugal, and new strategies will have to be found and adapted.

Despite the importance consumers attach to the existence of promotions, other factors that influence purchasing decisions are becoming increasingly important. Today's more demanding consumer is also looking for the quality of fresh products, convenience, assortment and innovation, among other attributes. In Portugal, 70% of shoppers are looking for healthy food, 2/3 are willing to pay more for higher quality and half admit to paying more to save time.

In fact, in basic categories, which are already in every household in Portugal, the strategy should be to try to offer other attributes that add value to the product and satisfy the needs that consumers are looking for and are willing to pay more for.

"However, in a country like Portugal, it's not necessarily mandatory to reduce promotional pressure. It is necessary to explore other opportunities to work on promotions, increasing efficiency to much higher values. Investing exclusively in promotions can lead us to miss out on some important attributes for the consumer, who is actually willing to pay more for them," explains João Otávio.

Nielsen's Sales Effectiveness area studies all the attributes capable of leveraging sales, such as Price and Promotions, helping clients to invest where and when it is most favorable for them. "It's essential to know exactly what the change in volumes will be for every 1% price increase. We know that the market leaders apply above-average promotional pressure in 80% of their categories, and are primarily responsible for boosting the prices offered to consumers. We urgently need to understand what opportunity each brand has to contribute to recovering the value of their categories," concludes João Otávio.