- Portuguese Retail Outlook: Good prospects for consumption in the Portuguese market

- Panorama of Portuguese Retail: High levels of competitiveness among banners

- Panorama of Portuguese Retail: The competitiveness of the market generates disloyalty: it is necessary to know the omnishopper

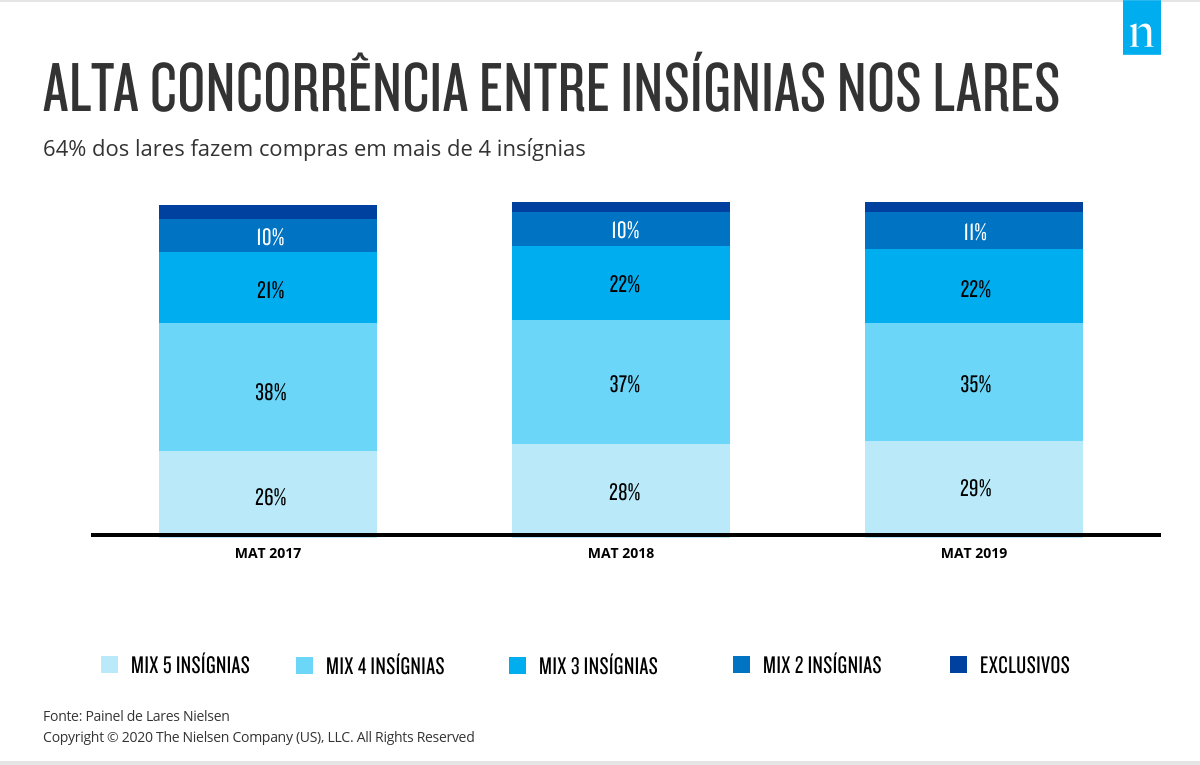

Lisbon, January 2020 - From its Household Panel, Nielsen has launched the Panorama of Portuguese Retail, a study aimed at pinpointing the preferences of the population. shoppers and the impact of the current retail reality in Portugal for manufacturers and retailers. Nielsen's analysis reveals that 64% of households in Portugal do their shopping in more than 4 banners, proving the high competitiveness of national retail. The information analyzed by Nielsen is the starting point for providing brands and retailers with the ability to understand the transformations underway, identify business opportunities in this competitive environment and make good decisions.

The report delves into the main movements and trends in retail in Portugal, answering questions associated with the spending, frequency and penetration of competing banners, the main interactions between them, the growth paths between each one and the expected future for retailers. stakeholders on the market.

A shopper who wants everything. One omnishopper.

In a positive scenario for consumption and with growing confidence in the national, economic and personal reality, the mindset of consumers is different today, as new habits are being consolidated.

With 89% trying new brands and products, the Portuguese are more experimental than in the past and seek innovation. Being more willing to pay more for higher quality products (68%), more than half of Portuguese consumers are interested in trying products from local or socially responsible brands and around ⅔ buy healthy food products, according to Nielsen's Shopper Trends report. On the other hand, the same consumers value their wallets and are looking for new products with lower prices.

O shopper Today's people are several things at once: they are more experimental, more local, more social, more responsible and more intelligent in their choices. They want everything and demand everything at different times. They are omnishopper.

An increasingly competitive market

The increase in the number of stores (+107 in 2019), greater penetration in households, the entry of new players and the weight of promotions in the market make the retail landscape highly competitive between banners in the modern channel, with greater intensification over the years and with interaction and movement of customers between all of them.

The growth of proximity channels is also helping to drive the market, meeting the convenience needs of shoppers, who are looking for an offer that saves them time and responds to their busy lifestyles.

High competitiveness generates low loyalty: it's essential to focus on the shopper

A highly competitive environment leads to less loyalty on the part of consumers, who end up making their purchases from various banners. 61% of households in Portugal have a lower loyalty rate to retailers than 20%.

Push" strategies - an offer based on the brand's needs - are not the most effective for achieving results in today's competitive and complex environment and in the face of a new paradigm of access to technology that has completely changed the power of the shoppers. To reach this unfaithful but willing consumer, you need to get to know them in order to implement an offer that meets their needs and desires, based on a "pull" strategy.

As Lahna Barbosa, Analytical Consultant for Nielsen's Household Panel team, explains, "the shoppers should be the main stakeholder of market strategies. Their preferences have to be at the center of manufacturers' and retailers' strategies, so knowing the consumer properly is essential in order to create winning strategies. Manufacturers are required to manage their portfolios based on data that allows them to understand market trends, while retailers are required to manage their points of sale with a focus on shoppers and use technology to manage experiences and expectations. Knowing the shopping cycle of the different occasions of this omnishopper is essential for thinking about and implementing winning strategies."

Where to find more information

The source of this analysis (Panorama do Retalho Português) is Nielsen's Household Panel, made up of a sample of 3,000 households in mainland Portugal, who record the FMCG products they buy in any shopping channel, in a regular and continuous collection of purchases via scanner.

This sample is demographically and geographically representative, portraying the 3.9 million households in mainland Portugal and thus allowing insights to be gained into the purchasing behavior and profile of Portuguese families.

About Nielsen:

Nielsen Holdings plc (NYSE: NLSN) is a global data measurement and analysis company that provides the most complete and reliable insight into consumers and markets around the world. Nielsen is divided into two business units. Nielsen Global Media, the truth indicator for media markets, provides the media and advertising industries with unbiased and reliable metrics that create a shared understanding of the industry necessary for markets to function. Nielsen Global Connect provides FMCG brands and retailers with information and insights and a complete overview of a complex and changing market that companies need to innovate and grow.

Our approach combines original Nielsen data and other sources of information to help global clients understand what is happening now, what will happen in the future and how to act on this knowledge.

An S&P 500 company, Nielsen is present in more than 100 countries, covering more than 90% of the world's population. For more information, visit https://www.nielsen.com/pt/pt/.

Say U Consulting