Normality of quarantine

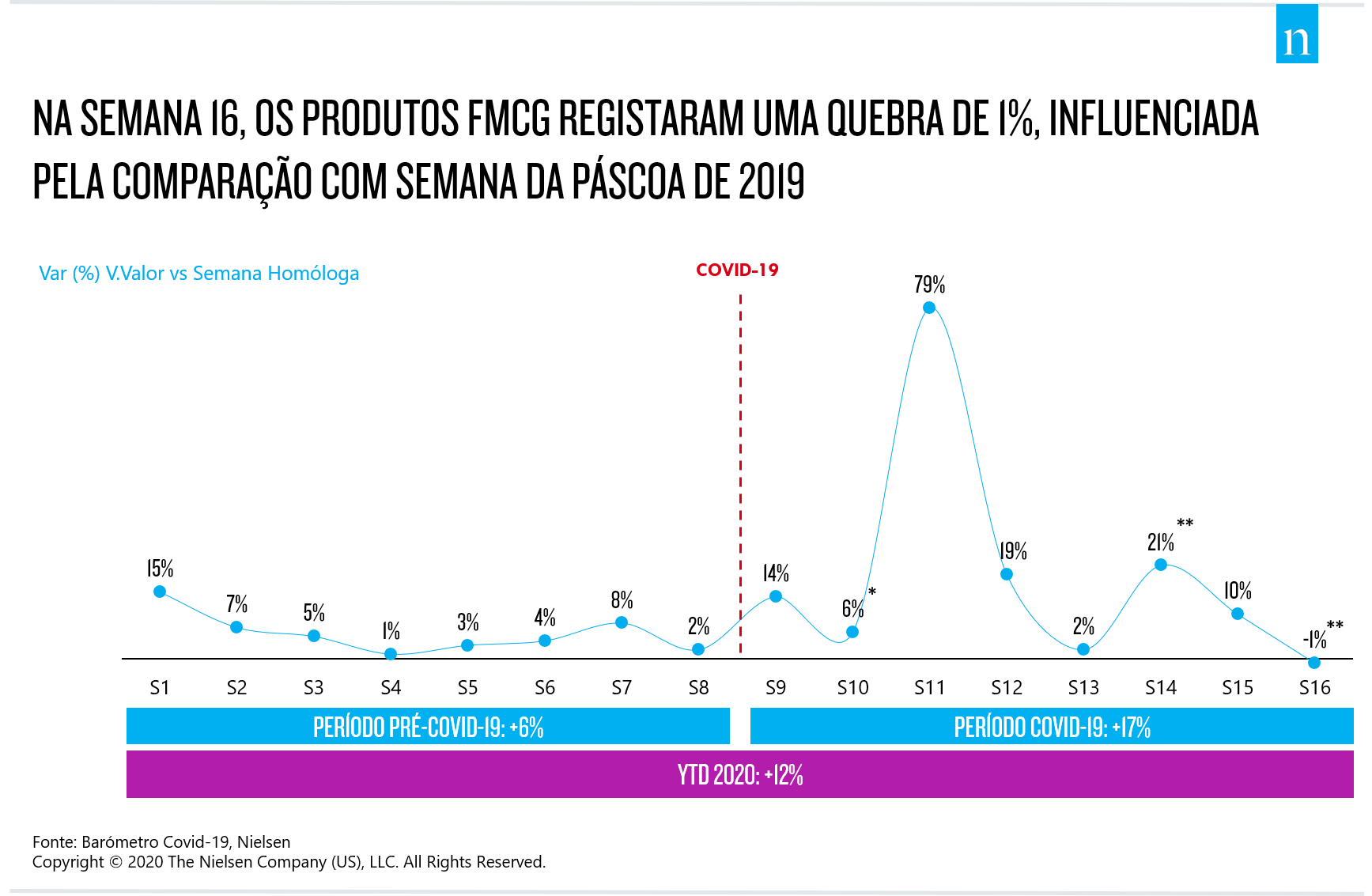

- 1% decrease in BGC compared to the same period last year, which included Easter

- Differing trends between countries close to Portugal

- Maximum growth in purchase occasions and number of households in the online channel

- Dynamism in Animal Products and Personal and Home Care

- Proximity channels maintain their weight above the pre-Covid-19 period

To the seventh edition of Nielsen's weekly Barometer on the impact of the COVID-19 pandemic - week 16, from April 13 to 19, 2020 - the quarantine continues after Easter, with the start of the third period of the state of emergency.

FMCG sales were 171 million euros this week, a decrease of 1% compared to the same period last year, influenced by the comparison with the later Easter week in 2019. Sales figures fell by 7% compared to the previous week, a trend that is repeated, as 2019 also saw a similar trend after this festive date.

The trend in Portugal is not entirely in line with the situation in other nearby countries. While in Italy there was a sharp drop in consumption this week (-16%), in Spain the scenario was the opposite, with an increase of 24%.

The highlight this week is also Online, which reached its maximum growth: 289% in the number of online purchases and 244% in the average number of households buying online.

Pet care and personal and home hygiene boost consumption

In this period, the growth in Pet Products (food and accessories for dogs and cats) and Personal and Home Hygiene stands out, with increases of 18% and 14%, respectively.

Conversely, "there was a negative trend among Food Products (-3%) and Beverages (-13%). This is fully justified by the fact that we are comparing this week with Easter week 2019, when these categories naturally reached higher values. This effect is even more noticeable in the Confectionery and Sweets category, with a drop of 51%," explains Marta Teotónio Pereira, Senior Client Consultant at Nielsen.

Normality of quarantine

"After a period in which the Portuguese tried to maintain the normality of their lives and consumption at a special time like Easter, they are now returning to a conditioned normality, to which they are already accustomed: the normality of quarantine. After Easter, the categories typical of life in quarantine stand out again in the context of Food, namely Hot Drinks, Canned Food, Frozen Food and Basic Products," explains Marta Teotónio Pereira.

Sales of fresh produce are down 18% (compared to the same week last year, which included Easter 2019). Fruits and Vegetables are bucking this trend, growing by 10%, as meals continue to be cooked at home, contributing to the strong growth in Vegetables, and the growth in Vitamin C-rich fruits proves that the concern for health continues.

Promotion continues its positive trend

In Promotions, the positive trend continues compared to week 15, but while in the previous week this promotional effect was due to the Leaflet gaining importance, the Temporary Price Reduction is now gaining importance.

Proximity remains relevant for consumers

The Proximity factor maintains a weight above that seen in the pre-Covid-19 period, with an importance of 14.1% in week 16, while in the pre-COVID period it stood at 12.5%.

However, in this week in which the state of emergency has been renewed and consumers continue to live in quarantine, it is the Hipers that are once again gaining weight: they represent 27.3% of the total number of channels analyzed in week 16, compared to 26.5% in the previous week.

About Nielsen:

Nielsen Holdings plc (NYSE: NLSN) is a global data measurement and analysis company that provides the most complete and reliable insight into consumers and markets around the world. Nielsen is divided into two business units. Nielsen Global Media, the truth indicator for media markets, provides the media and advertising industries with unbiased and reliable metrics that create a shared understanding of the industry necessary for markets to function. Nielsen Global Connect provides consumer goods brands and retailers with accurate, actionable information and insights and a complete view of a complex and changing marketplace that companies need to innovate and grow.

Our approach combines original Nielsen data and other sources of information to help global clients understand what is happening now, what will happen in the future and how to act on this knowledge.

An S&P 500 company, Nielsen is present in more than 100 countries, covering more than 90% of the world's population. For more information, visit https://www.nielsen.com/pt/pt/.

Contact details of Press Office

Say U Consulting