Easter in quarantine

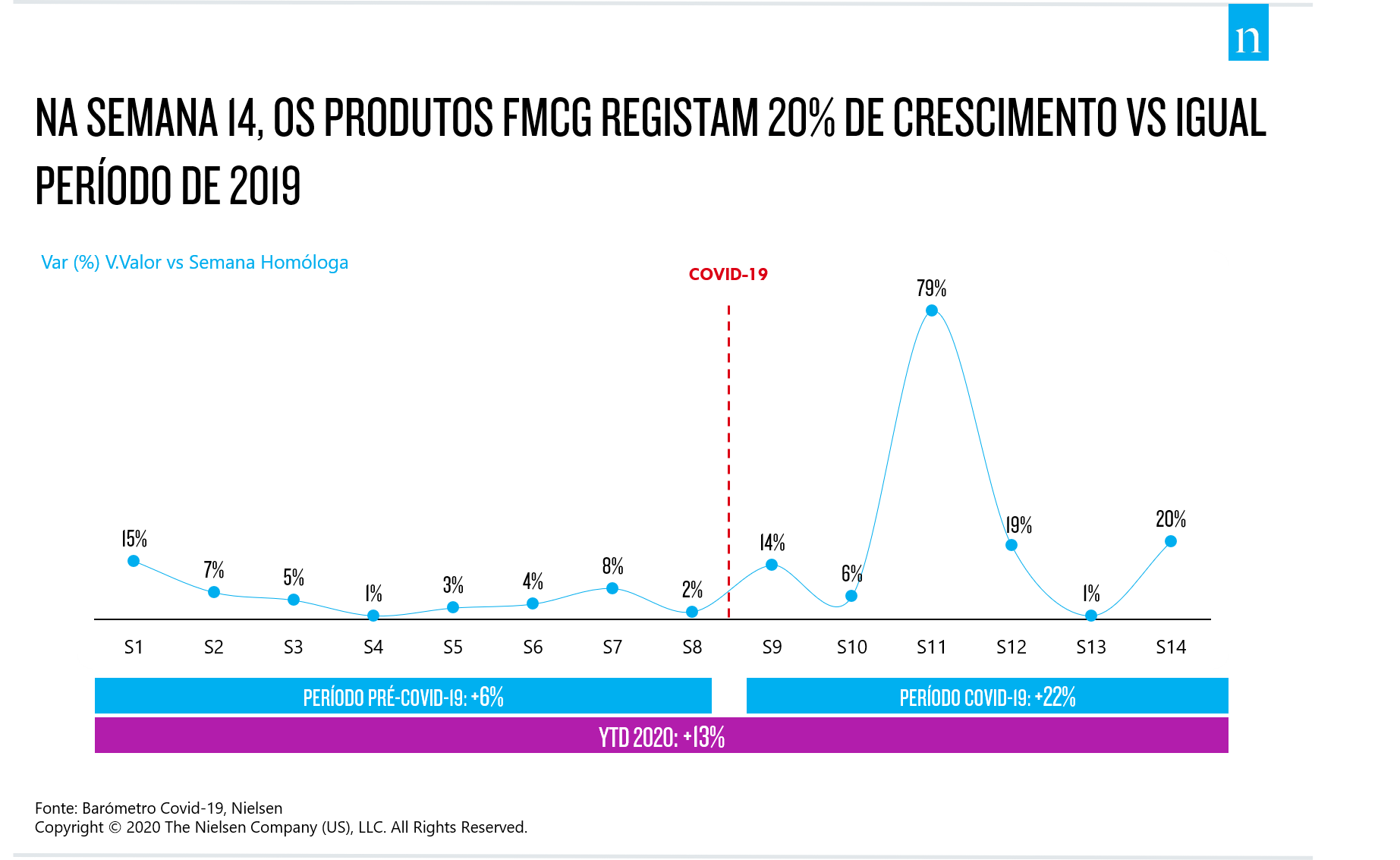

- 201TP3Q Growth in Major Goods Consumption in week 14

- The impact of Easter is reflected in Butcher's sales, even during the quarantine season

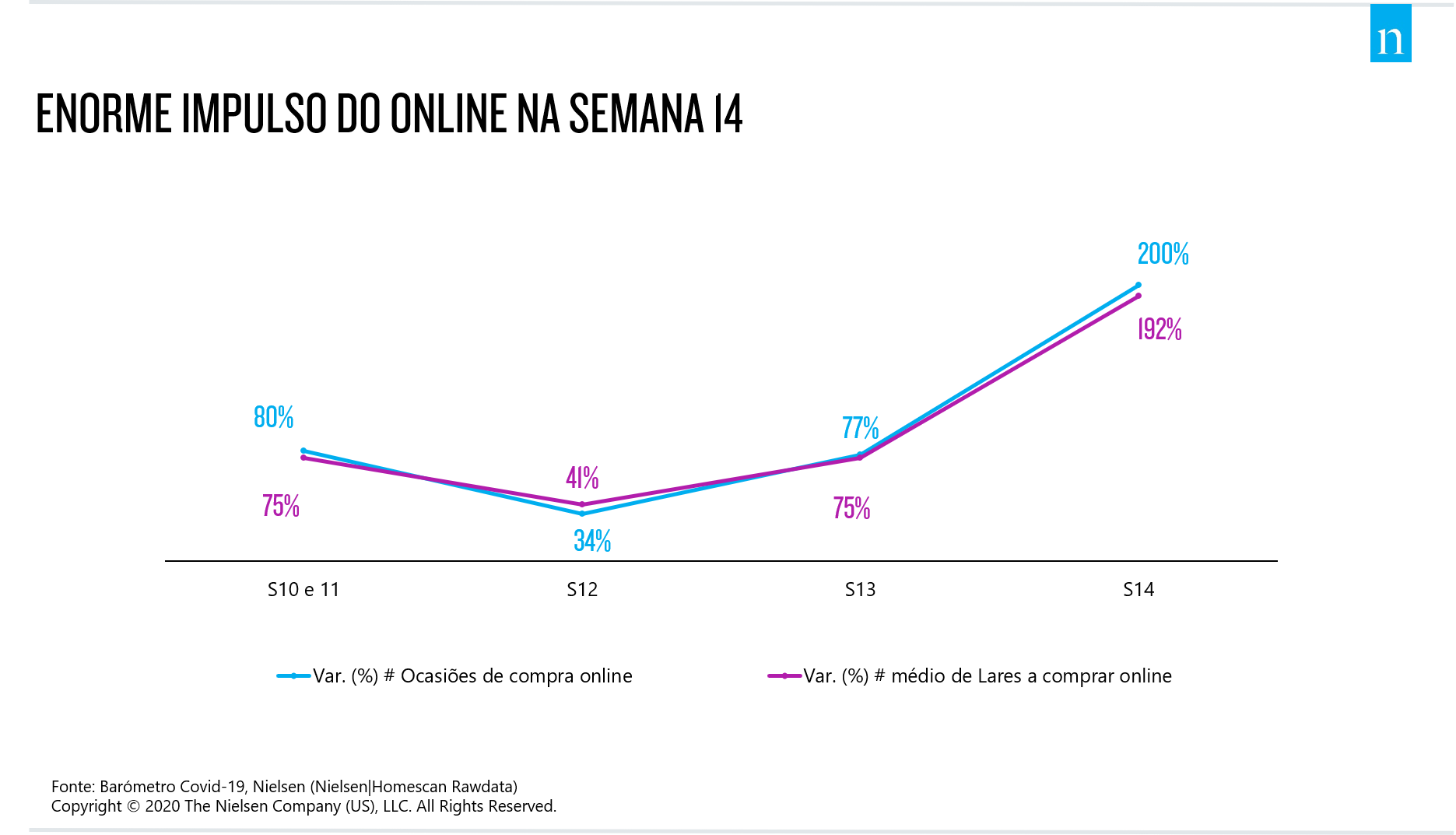

- Huge boost for the online channel, which grows 200% in purchase occasions

- Increased weight of Private Brand and drop in Sales with Promotion

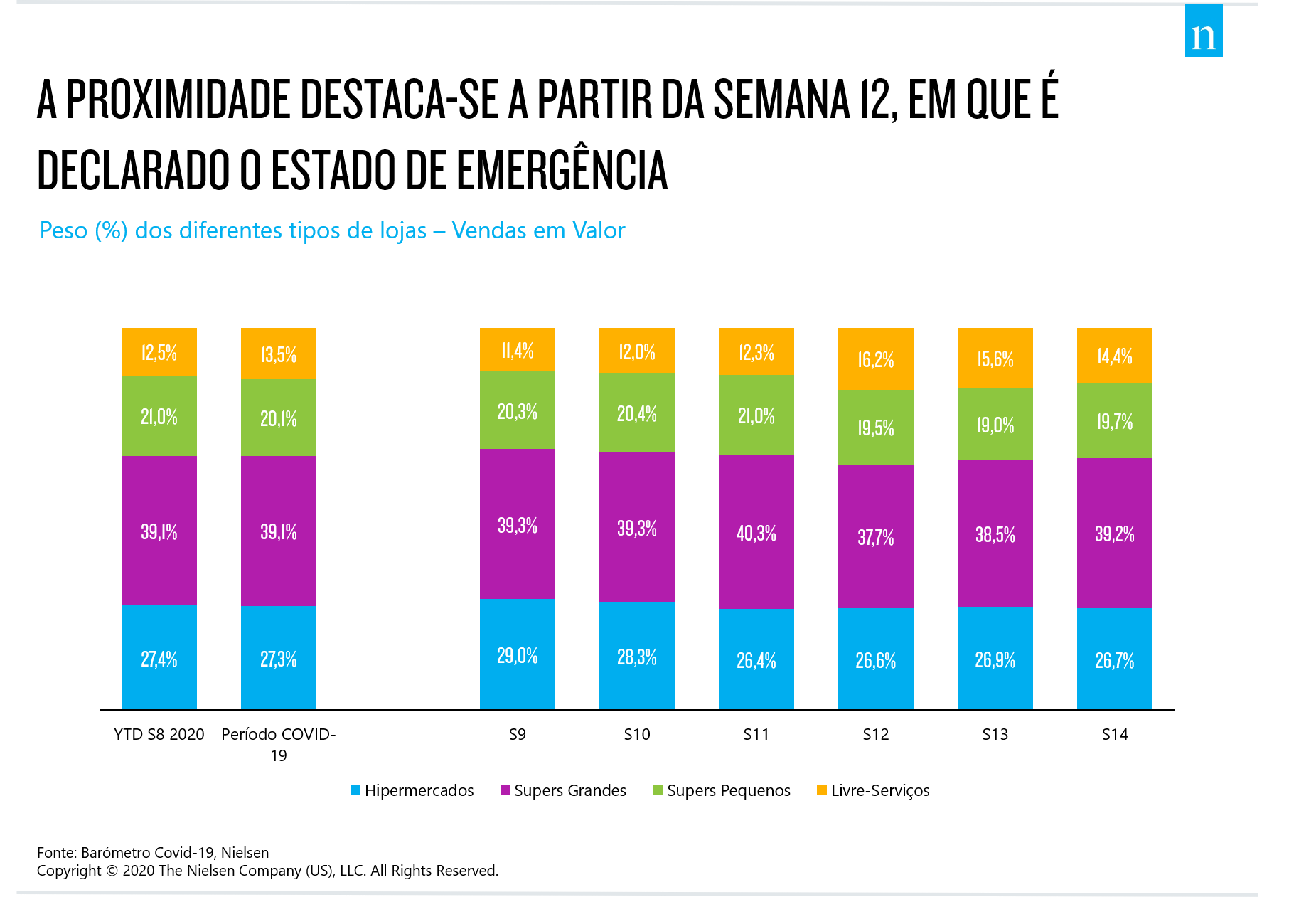

- Gaining importance of proximity channels as the Portuguese stay at home

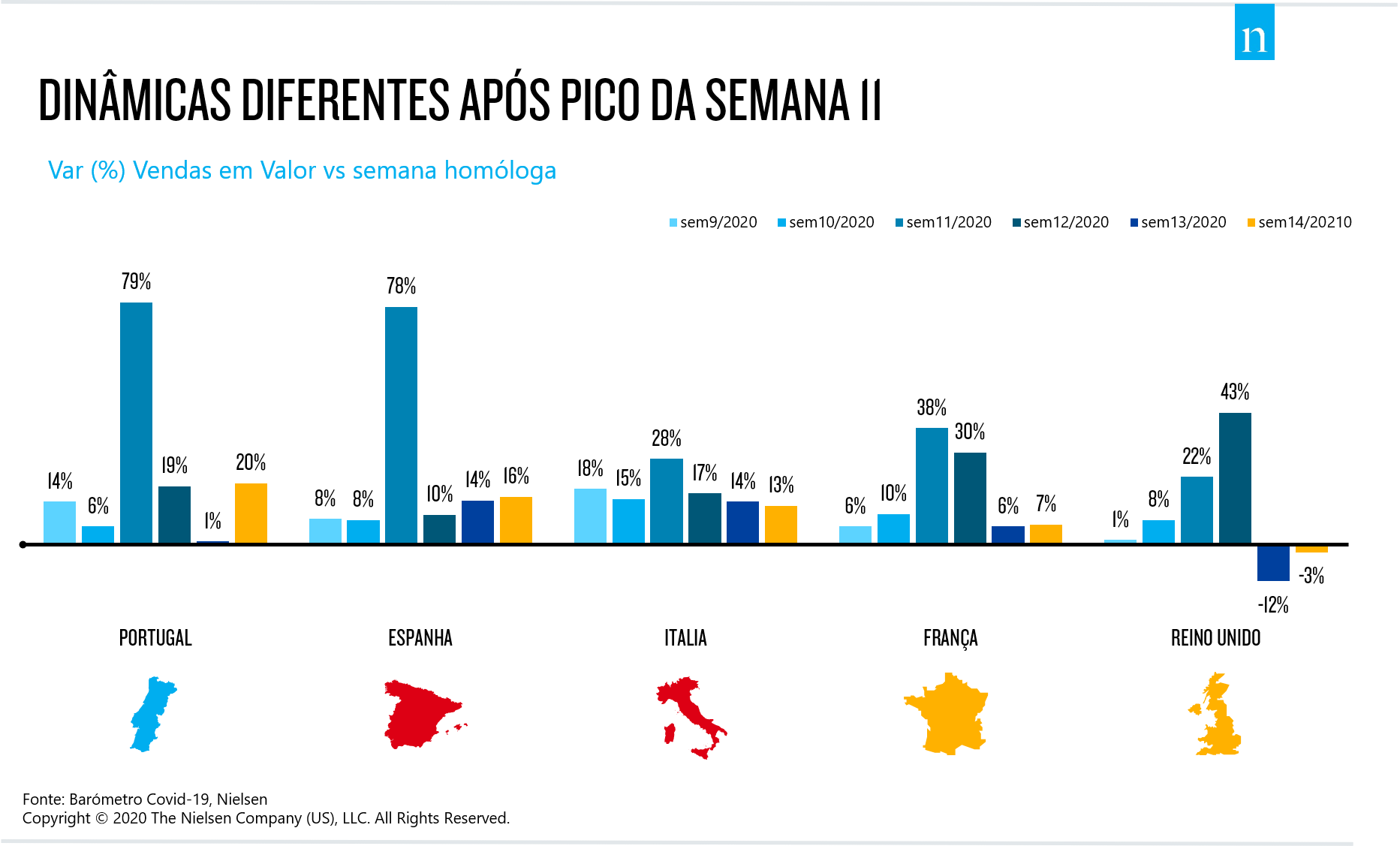

- Different dynamics in other Western European countries

In the week in which the barrier of 10,000 confirmed cases of Covid-19 infection in Portugal is broken, consumption is largely influenced by preparations for the Easter celebrations. The fifth edition of Nielsen's weekly Barometer on the impact of the pandemic records sales of around 187.5 million euros for week 14 (March 30 to April 5, 2020), an increase of 20% compared to the same period last year.

"The evolution of sales in the FMCG categories shows that the Portuguese who are in quarantine have been trying to ensure well-being and care for themselves, most likely to try to experience this new reality in the best possible way.

In this sense, the concern with Personal Hygiene products is more visible, namely Hair Removal (+31%) and Hair Products (+20%), which have entered the ranking of the biggest growths in Personal and Home Hygiene. At the same time, the products that remain at the top of growth in Fruits and Vegetables show a concern with defending the immune system: for example, Orange (+115%), Lemon (+98%), Tangerine/Clementine (+71%) and Kiwi (+33%).

Easter in quarantine

The figures for food retail sales for week 14 - the week before Easter - show that, despite the restrictions imposed on traffic in Portugal, the Portuguese have made plans to sit down at the table in their homes to celebrate this central time in the religious calendar and in family life," points out Marta Teotónio Pereira, Senior Client Consultant at Nielsen.

The Easter calendar, which is being celebrated earlier this year: on April 12 this year, whereas in 2019 it was on April 21, contributed to the gain in the period under review. Despite the current quarantine context, this week before Easter saw growth (+15%) compared to the previous week, which is in line with the usual dynamics for this time of year.

Even in the atypical situation we are experiencing, the impact of Easter is noticeable in the sales of the Butcher's Shop, which grew by 18%, especially sheep and goat meat (+85%), traditionally found at this time of year on the tables of Portuguese families.

The increase in consumption is also visible online, with a huge boost being felt in E-commerce. In week 14, the number of online shopping occasions grew by 200% and by 192% in new households.

Private label in counter-cycle with promotion

Looking at the evolution of the most recent weeks, we see that Private Brand gains weight from week 11 onwards, when the Portuguese were preparing their pantry to "face" the stay at home. If since the beginning of the year, and in a reality that was still pre-Covid-19, Private Brand growth was at 30.8%, after the start of the pandemic it is now at 32.8%.

The promotional trend, on the other hand, is in reverse and has fallen since the beginning of the pandemic's effects on the domestic market. While in the pre-Covid-19 period the average value of sales in Promotions was very close to 50% and in the first week of the virus in Portugal it even reached 51.2%, in week 14 the phenomenon of a drop is already fully perceptible, falling to 32.5%.

The growing weight of proximity

The demand for local solutions is particularly strong from week 12 onwards, when the State of Emergency is declared in Portugal and families are forced to stay at home due to school closures.

For the first time in this period, the Free-Service stores surpassed the 15% percentage barrier in terms of total sales in all types of stores nationwide.

Dynamics differ in the European context

It is clear that, even in the geographically closest European context, the dynamics of consumption are different, reflecting different impacts of Covid-19 and responses to it.

While in Portugal, Spain, Italy and France sales peaked in week 11, with smaller increases compared to the same period after that, the situation in the UK shows a peak in consumption in week 12 and decreases compared to 2019 in the following two weeks. A distinction that may show a parallel with a later reaction to this pandemic.

About Nielsen:

Nielsen Holdings plc (NYSE: NLSN) is a global data measurement and analysis company that provides the most complete and reliable insight into consumers and markets around the world. Nielsen is divided into two business units. Nielsen Global Media, the truth indicator for media markets, provides the media and advertising industries with unbiased and reliable metrics that create a shared understanding of the industry necessary for markets to function. Nielsen Global Connect provides consumer goods brands and retailers with accurate, actionable information and insights and a complete view of a complex and changing marketplace that companies need to innovate and grow.

Our approach combines original Nielsen data and other sources of information to help global clients understand what is happening now, what will happen in the future and how to act on this knowledge.

An S&P 500 company, Nielsen is present in more than 100 countries, covering more than 90% of the world's population. For more information, visit https://www.nielsen.com/pt/pt/.

Contact details of Press Office

Say U Consulting