Confidence Index

- National confidence index overtakes Europe

- Volumes recover in FMCG

- Portugal in the top 10 for value growth among 28 European countries

The climate remains positive in Portugal. The Portuguese are confident and willing to spend. Health, leisure and well-being are now part of their concerns. Everything points to a scenario of growth in FMCG. And that's exactly what happened in the first quarter of 2019. These are the results of Nielsen's Confidence Index and Growth Reporter studies. What will the rest of the year bring?

91 points: Portugal overtakes Europe

Portugal has a Confidence Index of 91 points, one of the highest ever. Reversing their historical pessimism, the Portuguese now show a higher level of optimism than the European average (83 points), surpassing countries such as Spain (88), France (72) and Italy (68).

Health and work-life balance are priorities for consumers. These two concerns are both mentioned by 28% of consumers, leaving employment, rising bills or the economy almost ten percentage points behind. In an increasingly ageing country, the well-being and happiness of parents is also a top concern.

After paying their usual expenses, fewer and fewer Portuguese say they have no money left (although they still represent 1/5 of the population). Of the money they do have left over, more and more are spending it on entertainment away from home, vacations or trips. However, the Portuguese once again point to savings as their main priority (50%).

Volumes recover in Portugal. Europe falls 0.51TP3Q

In previous periods, Nielsen had seen a stabilization of growth in volumes, i.e. consumption itself was not increasing, but only in value. However, in the first quarter of 2019 we saw growth of 1.6% in volume, contrary to what is happening in Europe, where volumes fell by 0.5%.

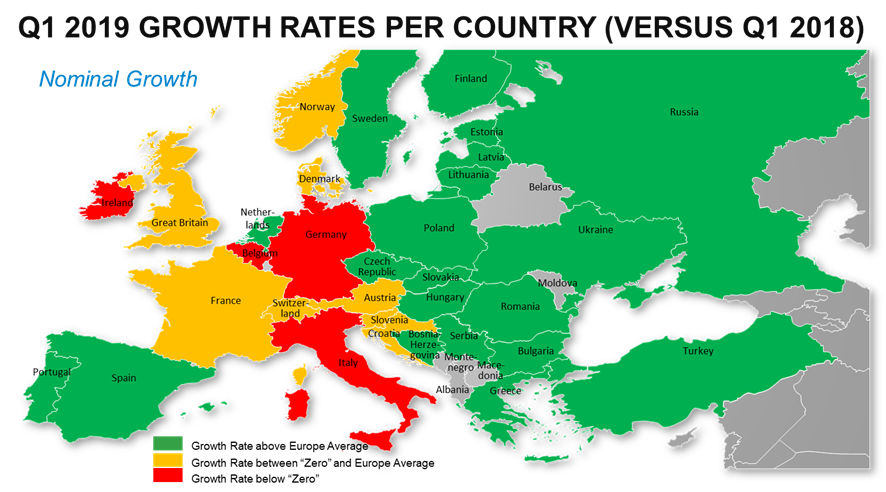

In terms of value, Portugal also stands out in relation to the European average, making it into the Top 10 countries with the highest growth in value (3.1% in Portugal; 2.4% in Europe). In total, BGC reached almost €2 billion in this period. The price effect also grew by 1.5% in this period, proving that the Portuguese are buying more and at higher prices.

In this first quarter, Beverages was the most dynamic category, with Alcoholic Beverages growing by 10% and Non-Alcoholic Beverages by 9%, in a period in which there were higher temperatures than in 2018, contributing to the category's greater growth. It should also be noted that, in this analysis, the period corresponding to the first quarter includes December 31, 2018 (unlike the previous year), which contributes to the greater dynamism of Alcoholic Beverages, as well as Food, which gain prominence in these periods.

In total BGC, it was Manufacturer Brands (+4.4%) that stood out the most compared to Distribution Brands (+0.6%).

What will the rest of the year be like?

"The increased level of confidence among Portuguese consumers and their focus on well-being, health and leisure are signs of a change that has already taken place. The Portuguese are more positive, have more money available, and want to spend it on something that brings them some kind of benefit. After a period of some stabilization in volumes and growth in value, we are now seeing growth on both sides: this quarter, consumers bought more and also spent more. For the rest of the year, and given that there have been no increases in population, we don't expect very significant increases in volumes. However, we have identified many opportunities for growth in the value-added categories, which will certainly bring more room for growth in value," comments Ana Paula Barbosa, Retailer Services Director at Nielsen Portugal.