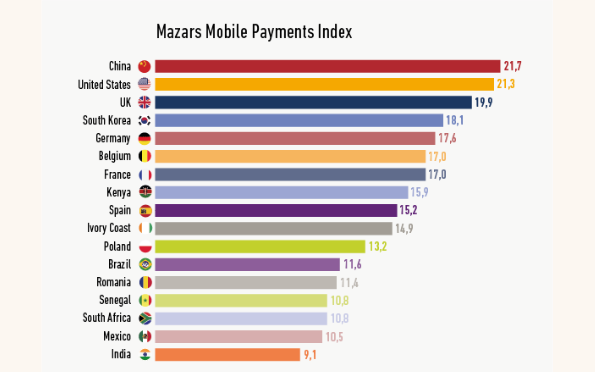

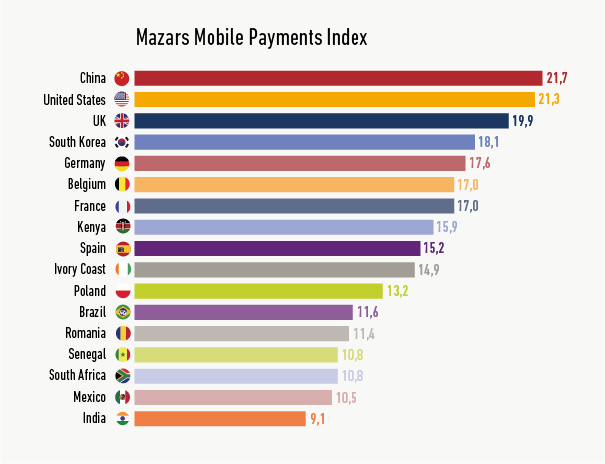

Mazars Mobile Payments Index

Mazars has released "The Future of Telcos", a study that identifies which markets worldwide offer the greatest opportunities for mobile financial services. The report - which analyzes 17 markets and ten variables related to consumer behavior, mobile payment penetration, regulation and infrastructure - finds that China, the UK and the US emerge as the markets with the greatest potential. South Africa, Mexico and India are at the bottom of the Index.

November 04, 2019: Mazars, the international consulting and auditing firm, announces the publication of its study "Future of the Telcos: Winning the customer experience battle. The case of mobile financial services". Containing insight of ten in-house experts, the report reveals how telecom companies are positioned to strengthen customer loyalty and grow their bottom line if they are able to use financial capabilities in mobile to shape and incorporate the integrated consumer experience.

A centerpiece of the report, the Mazars Mobile Payments Index demonstrates the opportunities for Telcos to use mobile financial services to win the battle for the consumer experience. Of the 17 markets analyzed, the countries in the top 3 are China, the US and the UK. The bottom three are South Africa, Mexico and India.

Julien Huvé, Head of Telecommunications Services at the Mazars group notes that "Telcos' business is changing. Connecting people is no longer enough - instead, Telcos want to play a leading role in shaping the consumer experience. By using their devices to unlock shared or autonomous cars and shop without having to pick up a physical wallet, consumers are on the verge of an integrated experience. This is the opportunity for Telcos, who can use mobile financial services to make the possibilities a reality".

"The Mazars Mobile Payments Index reveals which markets present the greatest opportunities and challenges for Telcos looking to grow their business and evolve their offer beyond simple connectivity and digital access"Huvé adds.

By analyzing markets based on ten different variables related to regulation and infrastructure, consumer behavior and mobile payment penetration, the index provides a baseline against which to compare mobile financial services opportunities on a global level.

Focus on China: a cashless society on the rise

Ranked first in the Mazars Mobile Payments Index, China is at a great advantage when it comes to the use of mobile payments: these have increased tenfold since 2012. The market is continually defined and driven by its two technological giants: Tencent's WeChat Pay and Alibaba's Alipay.

Some of China's key figures:

- 8 billion dollars is the value of the mobile payments market in China (2018)

- 132% is the registered rate of mobile payment accounts among the population (2017)

- 13,5% share of the mobile payments market for Telcos

- 9,2% is the percentage of the population that only uses mobile banking services

Ranked second in the Mazars Mobile Payments Index, the digitization of financial services in the US has been gradual. Although the US market is fragmented, it still offers excellent conditions for the implementation of mobile financial services. The UK emerges as a European pioneer in the Mazars Mobile Payments Index thanks, above all, to its strong performance in regulation and infrastructure. The isolated approach proposed by the regulator seems to be very effective in promoting innovation in this context.

Contact details of Press Office

Say U Consulting