Quarantine: Portuguese prepare basket

- Consumption slows down in the week that the State of Emergency is declared in Portugal

- Portuguese adopt more economical and rational consumption

- Long-life products record the highest growths

- Concern for animal welfare promotes sales of Animal Products

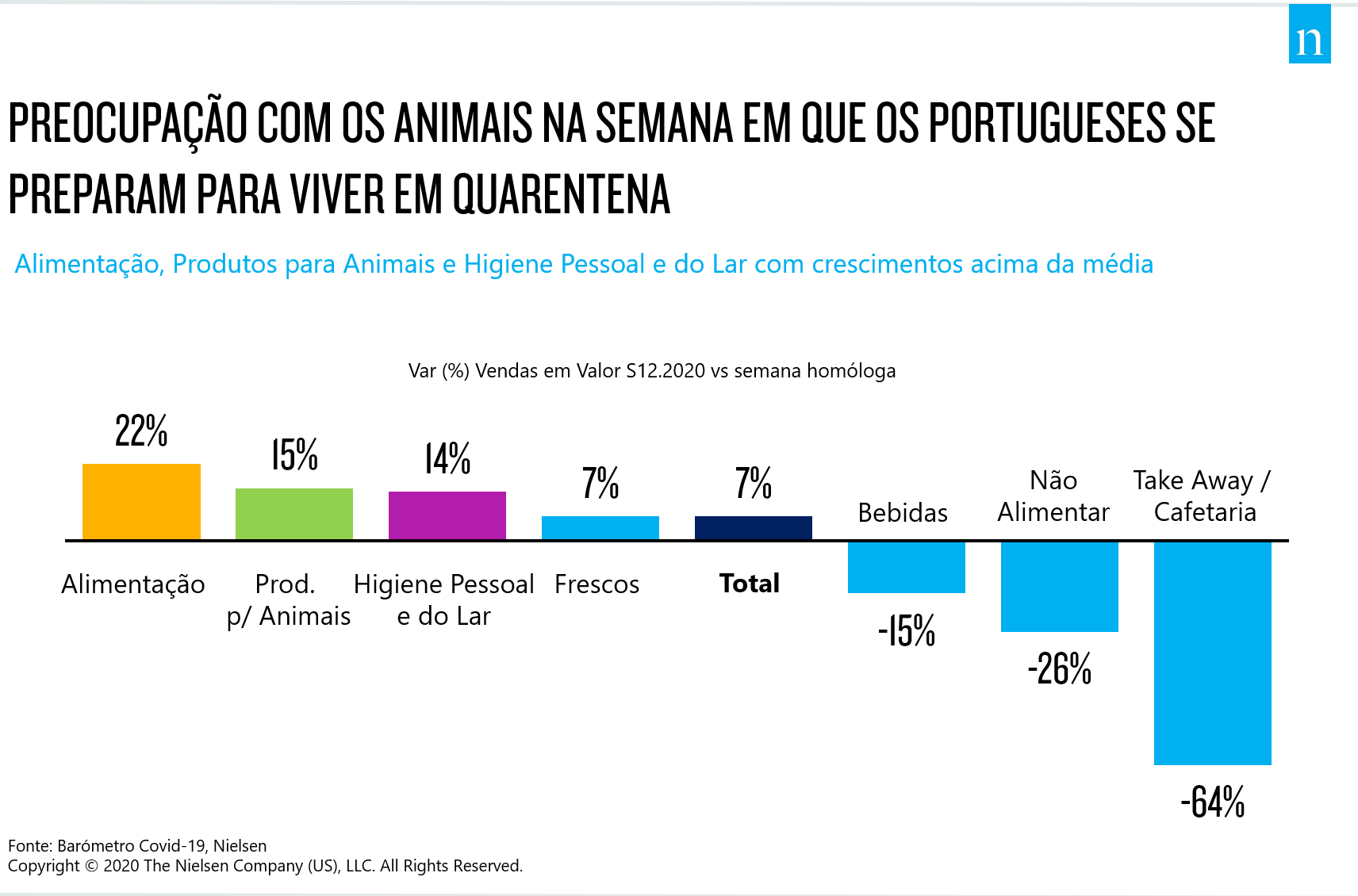

The third edition of Nielsen's weekly Barometer on the impact of the Covid-19 pandemic on consumption saw the declaration of the State of Emergency and the closure of schools, which led to families staying at home and a consequent slowdown in sales. Growth in week 12 (March 16-22, 2020) compared to the same period last year is 7%, a considerable slowdown compared to the previous week (+65%).

Portugal was not alone in this slowdown, and this trend is visible in other countries, particularly Spain.

In Portugal, this period begins with the dramatic news of the first death from Covid-19, in a period that is also marked by the imposition of restrictions on movement - through the control of land borders and air connections - and the closure of commercial establishments considered non-essential.

Portugal thus enters the fourth of the six stages identified by Nielsen - #4 Preparation for Quarantine.

Long-lasting products are the answer to quarantine

In food, in week 12, it was long-life products that recorded the biggest increases, especially Canned Food (+79%) and Basic Products (+68%). Lisbon and Setúbal stood out with very high growth in these categories, with figures of +89% and +74% for Canned Food and +75% and +65% for Basic Products, respectively.

In the week in which the Portuguese are preparing to live in quarantine, we also see an increased concern for pets. Pet Products (food and accessories) grew 15% compared to the same period last year.

Paper products remain at the top of the Personal and Home Care ranking, with the most notable growth in Toilet Paper (+75%), followed by Tissues, Rolls and Napkins and Cleaning Accessories.

Among Home and Personal Care products, the biggest falls were in segments that clearly demonstrate the fact that the Portuguese are now at home: Make-up (-54%), Perfumes (-53%), Footwear Products (-47%), Air Fresheners (-38%), Skin Creams (-33%) and Shaving Products (-22%).

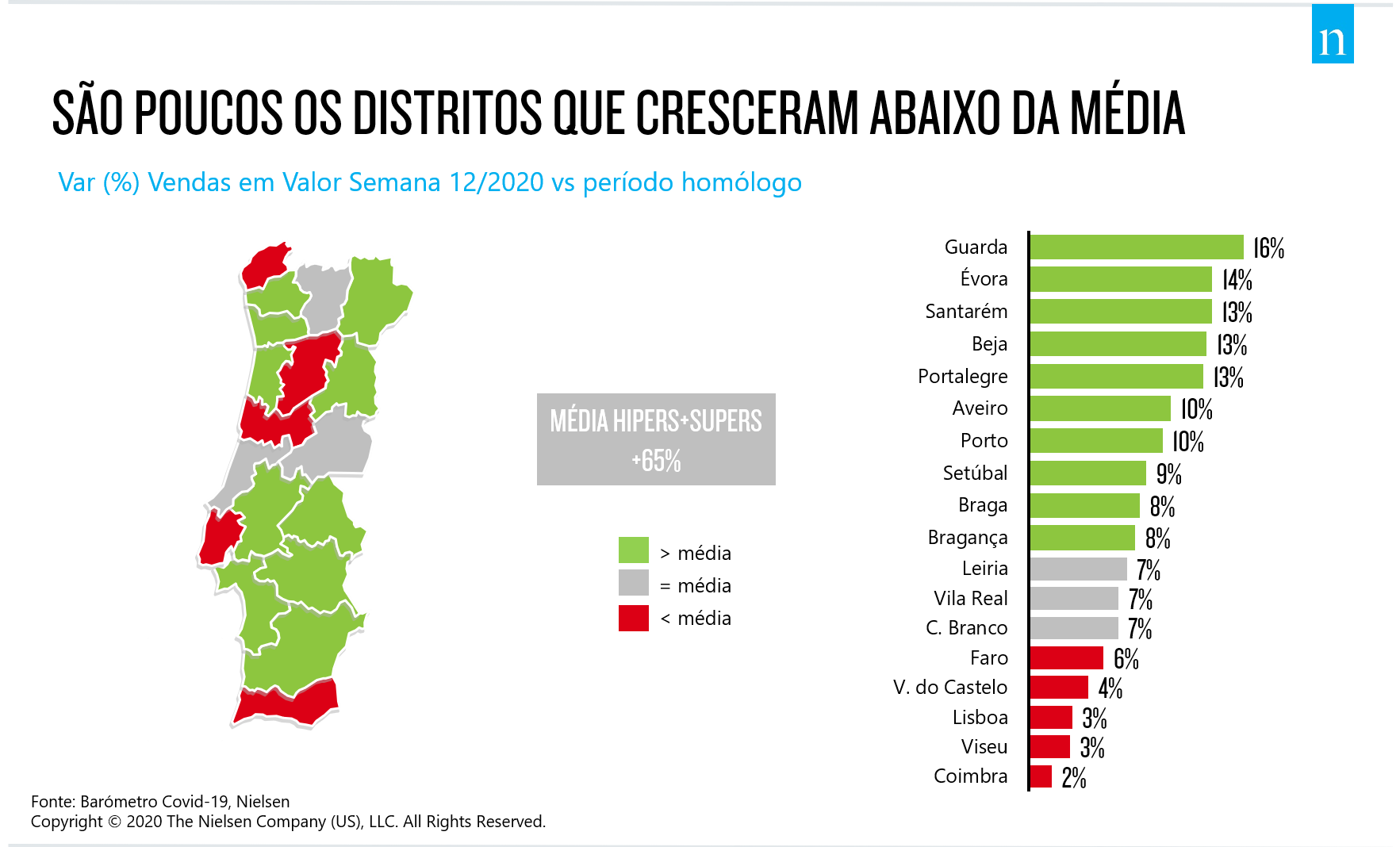

Few districts grow below average

In week 12, the growth in sales compared to the same period last year was felt in most of Portugal, with the exception of a few districts.

It was in Coimbra (+2%), Viseu (+3%), Lisbon (+3%), Viana do Castelo (+4%) and Faro (+6%) that there were increases below the average growth in value of 7% in this period.

A rational shopping basket, but also an emotional one

The shopping basket of Portuguese consumers has acquired survival features, reinforced for whatever may happen in this situation. But this is an evolving basket, which began with some initial symptoms and has quickly adapted to all the changes we are experiencing.

With the declaration of the State of Emergency in Portugal, imposing restricted outings, Portuguese consumption has become more economical and rational. As Marta Teotónio Pereira, Senior Client Consultant at Nielsen, explains, this is a reality "that may also be impacted by the evolution of the financial conditions of the Portuguese. After this phase in which the Portuguese prepared their lives for quarantine, it is natural that they are now looking to make life at home more bearable. There will therefore be some less essential products that may show growth, such as some categories of drinks. Even some beauty products may also have a more prominent place at home in this phase when we can't go out (e.g. trips to the hairdresser). The evolution of the composition of the quarantine basket is therefore experiential and emotional, and there is an opportunity here for manufacturers and retailers to achieve incremental sales."

In this context, consumers are looking for solutions that make it easier for them to stay at home, which is why the number of online shopping occasions has grown by leaps and bounds.

34% in week 12 vs. the same period last year, with +41% of households choosing this

channel (Source: Nielsen Homescan Consumer Panel Rawdata). We will continue to monitor these trends until the crisis stops and we return to (new) normality," explains the head of Nielsen.

About Nielsen:

Nielsen Holdings plc (NYSE: NLSN) is a global data measurement and analysis company that provides the most complete and reliable insight into consumers and markets around the world. Nielsen is divided into two business units. Nielsen Global Media, the truth indicator for media markets, provides the media and advertising industries with unbiased and reliable metrics that create a shared understanding of the industry necessary for markets to function. Nielsen Global Connect provides consumer goods brands and retailers with accurate, actionable information and insights and a complete view of a complex and changing marketplace that companies need to innovate and grow.

Our approach combines original Nielsen data and other sources of information to help global clients understand what is happening now, what will happen in the future and how to act on this knowledge.

An S&P 500 company, Nielsen is present in more than 100 countries, covering more than 90% of the world's population. For more information, visit https://www.nielsen.com/pt/pt/.

Contact details of Press Office

Say U Consulting