"Consumption reset

- Direct link between FMCG sales and the evolution of the pandemic is disappearing

- Consumption stabilizes after COVID-19 peaks

- Economic instability and financial worries bring changes to consumption

- 77% of Portuguese say they save more

- The 4 pillars that will transform the consumer: what, where, why and how much?

The COVID-19 pandemic has had a profound impact on consumer needs, FMCG purchasing dynamics and the definition of new trends in the relationship between companies and consumers. At a time when the economy and employment have become unstable and consumers have become accustomed to new habits, a new reality and new behaviors have emerged to which the market will have to adapt. The "Reset" of consumption has arrived, the "New Normal".

Scott McKenzie, head of Nielsen's Intelligence Unit, points out that "the unique conditions caused by a pandemic that has led to an economic recession are forcing consumers to rethink how they buy and what they buy. Human beings usually have months or years to adjust to new conditions. But this is no longer the world we live in. Faced with new consumer needs, brands must be highly focused and agile in their responses."

A change in behavior in the face of new concerns

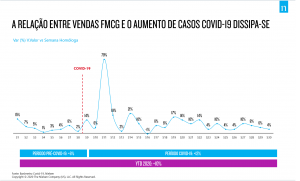

The media coverage associated with the novel coronavirus in the first quarter of this year has led to changes in global consumption, with a link between the evolution of the pandemic and consumer trends. Sales of hand sanitizer, staple foods and cleaning products, among others, have soared in the face of the spread of the virus.

Over time, however, this correlation has tended to dissipate and the consumer basket no longer responds so immediately to the news cycle in the media. This does not mean, however, that consumers have retreated from buying these types of goods. It just means that their purchase is no longer a reflection of the news about the increase in virus transmission rates.

New socio-economic panorama brings changes to consumption | "Reset" of consumption

The change in habits that we have seen over the last few months, plus new economic and employment instability, means that consumers need to re-evaluate their spending habits. But this impact will not be homogeneous: constrained spenders, those whose incomes have been negatively impacted by COVID-19, will spend to survive, while insulated spenders may momentarily adjust their spending, even though their incomes have remained stable.

unchanged by the pandemic.

"As consumer behavior shifts away from the news cycle, the components of the shopping basket will bend to the economic downturn and the transformation of the workforce," explains Scott McKenzie of Nielsen. "Consumers, whether they are employed or not, are less optimistic about the future. This caution will force them to reconcile purchasing habits adopted over the last few years with a new reality in which health and the perceived value of products are the priority factors."

"Consumption reset - What's going to change?

In analyzing these new trends, Nielsen has identified four patterns that can help predict the factors that will weigh on purchasing decisions in the future, including reconfigurations of the basket (basket reset), the takeover of "do-it-yourself" (homebody reset), the change in purchasing rationale (rationale reset) and increased attention to the value of products (affordability reset).

- What? A basket in transformation

Consumers can be expected to carefully evaluate the products that are part of their shopping basket, as they increasingly find themselves unable to maintain the level of spending seen at the peak of the COVID-19 response and the horizon of what is considered "essential" in a purchase is narrowing.

- Where? Reorienting consumption at home

Over months spent at home, consumers have embraced a do-it-yourself mentality when it comes to consumption. Bakers, pastry chefs, barbers, hairdressers and chefs were born in every home. And even though most of the restrictions on the movement have come to an end, some of these habits are here to stay, transforming consumer buying behavior as well.

This change in consumption at home aligns perfectly with the transformation required of today's business environment. Brands that succeed in leveraging the discovery and learning of DIY behavior will succeed by aligning themselves with today's interest in creative, conscious and safe consumption. Consumers are now available to bring the experience of a product into the safety of their homes.

- Why? A new purchasing rationale

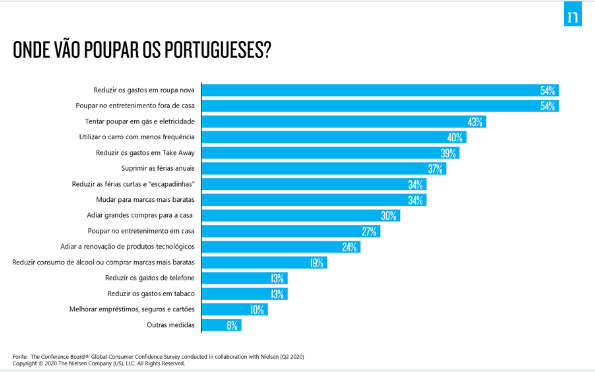

Faced with the current economic climate and rising unemployment, consumers may find themselves with less income. 77%1 of Portuguese say they have changed their spending in order to save on household purchases (compared to only 66% of Europeans). With less being spent on meals, travel, entertainment and clothing, Nielsen predicts that FMCG goods will take on a new meaning and become a way of filling the void left by these savings.

In a family of constrained spenders, the purchase of refrigerated meals can replace what were once higher-priced food products, while insulated spenders can buy a premium alcoholic beverage to drink at home or expand their personal care products as a substitute for the out-of-home dining or travel experiences they now don't have access to.

Brands looking to reposition their products in this new reality need to show empathy and recognize the changes associated with these consumer "luxuries". If they are able to recognize and leverage this situation, they will benefit most from consumers seeking comfort through low-value FMCG purchases.

- How much? Rethinking the value of products

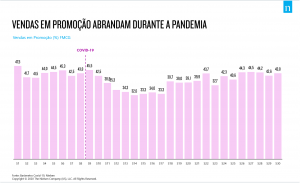

Since the beginning of the pandemic, we have seen significant reductions in the level of promotions around the world, particularly in Portugal. "We clearly see an indication that the promotional base has been rethought, leading to a huge opportunity to change consumer behavior around product accessibility. The recent absence of normal promotional activity leads to an important and historic moment in which brands will be able to rethink their approach more efficiently."

In this environment of huge consumer disruption and changing trends, it is up to brands and retailers to continue to assess the perceived value that consumers attach to each moment of purchase. The economic climate is leading to huge changes in consumers' financial outlook. Brands and retailers that are unable to offer products that can adjust to more limited financial availability and increased price sensitivities may lose long-term traction with consumers who are essential to securing their business. This is a challenge that requires the ability to anticipate, understand a new reality and restructure the offer in a "New Normal", the "Reset" of consumption that has already arrived.

About Nielsen:

Nielsen Holdings plc (NYSE: NLSN) is a global data measurement and analysis company that provides the most complete and reliable insight into consumers and markets around the world. Nielsen is divided into two business units. Nielsen Global Media provides the media and advertising industries with unbiased and reliable metrics that create a shared understanding of the sector that is necessary for markets to function. Nielsen Global Connect provides FMCG brands and retailers with accurate, actionable information and insights and a complete view of a complex and changing market that companies need to innovate and grow. Our approach combines original data from Nielsen and other sources of information to help global clients understand what is happening now, what will happen in the future and how to act on this knowledge. An S&P 500 company, Nielsen is present in more than 90 countries, covering more than 90% of the world's population. For more information, visit https://www.nielsen.com/pt/pt/